For small-business owners, expert management of finances is crucial for success. However, many entrepreneurs find themselves struggling with the common bookkeeping problem of reconciling their bank statements with handwritten logs of sales and expenses.

This discrepancy can lead to financial chaos and missed growth opportunities. Double entry bookkeeping offers a better way to manage your business’s finances and avoid the penalties caused by incompliance with tax laws.

To help you on your journey to manage your accounts efficiently, we will discuss everything you need to know about double entry accounting and explore how it can be beneficial for your business.

The Purpose of Double-Entry Bookkeeping

A double entry bookkeeping system provides a more reliable alternative to single-entry accounting, where transactions are recorded simply as additions or subtractions to a single business account. This robust system enables you to create additional accounts to monitor your accounts receivable, accounts payable, and inventory.

Double-entry accounting has become a staple for many companies, as it helps prepare accurate financial statements, including the balance sheet, income statement, and cash-flow statement. It is also indispensable for accrual accounting, which records revenue and costs as they occur but before they are received or paid.

Moreover, if you are considering asking for a loan or equity investment, lenders and investors prefer financial statements prepared using double entry accounting (as they provide complete and accurate information) to evaluate your business’s financial health. This makes double entry accounting crucial for your business.

How Double-Entry Bookkeeping Works

At the heart of double-entry bookkeeping lies a fundamental concept known as the accounting equation. This equation is the foundation for your business’s balance sheet, which is one of the three essential financial statements, alongside the income and cash-flow statements.

The term “balance sheet” implies the need for a business’s assets to match its debts and obligations used to finance them. Ideally, a business should have more assets than debts and liabilities; this surplus represents the ownership or shareholders’ equity.

Double-entry bookkeeping, or double entry accounting, is a systematic method of recording every business transaction twice, where entries on the left are called debits and entries on the right are credits. The software or document where these financial transactions are meticulously recorded is known as the ledger.

The recorded debits and credits should be equal but opposite in value. Here, one entry signifies the source of money for the transaction, while the other entry represents where the money is headed. These entries are organised into two columns, as mentioned above, and the key principle is that they must always balance each other. As a business owner, this balance allows you to meticulously track the flow of money into and out of your enterprise through periodic reviews known as trial balances.

Benefits Of Double Entry Bookkeeping

Implementing double-entry bookkeeping offers several advantages, including:

- Accurately Analysing Cash Flow: Multiple accounts help you comprehensively analyse how money flows through your business, giving you more control over cash flow.

- Determining Profitability: Double-entry accounting makes calculating your business’s profit easier, helping you identify the most and least profitable areas.

- Detecting Errors and Theft: Double entry simplifies identifying and correcting accounting errors. Thus, it helps you promptly uncover and address fraud or embezzlement within your organisation.

- Facilitating Third-Party Reviews: Banks and investors prioritise double entry accounting as a reliable source of accurate financial statements to assess your business’s financial health. Thus, implementing double entry accounting helps you gain the confidence of investors and banks.

Double Entry Vs. Single Entry Bookkeeping

Here’s a quick comparison between double entry and single-entry bookkeeping:

Frequency: Transactions are recorded only once in single-entry bookkeeping, whereas double entry records them twice in equal but opposite amounts.

Applicability: Single-entry may suffice for small businesses like freelancing or businesses where transactions rarely occur, while double entry is more suitable for larger enterprises with frequent transactions and more employees.

Account Types: Single-entry uses only personal and business cash accounts, whereas double entry employs nominal accounts for revenue and expenses and real accounts for assets, liabilities, and equity.

Complexity: Single-entry is simpler but incomplete, while double entry is more complex but provides a more comprehensive financial picture.

Information: Double entry accounting offers more information, making it easier to assess your business’s financial condition when compared to single-entry bookkeeping.

Tax Preparation: Tax filing can be more challenging with single-entry bookkeeping, as it provides less transaction information for proper tax treatment. This makes switching to double entry accounting a wise choice for smooth tax filing.

Conclusion

Double-entry bookkeeping is a valuable resource for small business owners if you wish to keep your finances well organised and transparent. With this accounting method, you gain greater command over your business’s financial affairs, can make well-informed choices, and meet the requirements of lenders and investors efficiently.

While double entry accounting might seem more intricate than single-entry methods, you can always outsource such services to a reliable accounting firm in the UK. So, don’t hesitate; start using double entry bookkeeping today and set your business on the path to financial prosperity.

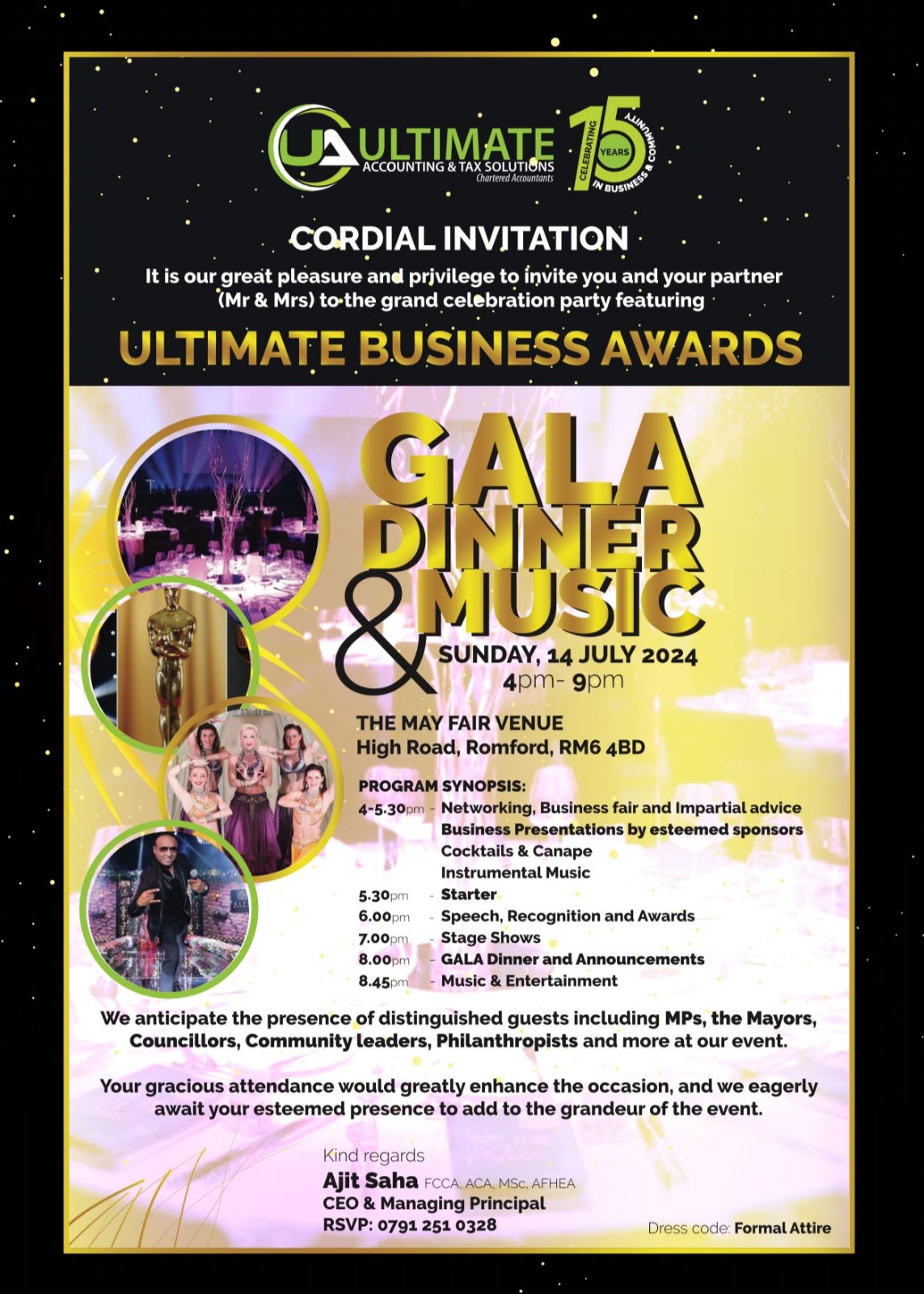

Are you looking for “bookkeepers near me” in the UK for your double entry accounting needs? Look no further than Ultimate Accounting & Tax Solutions. With more than 14 years of experience in the bookkeeping industry, we have a team of proficient chartered accountants who can offer efficient accounting solutions tailored to your business’s specific needs.

Contact us today to optimise your finances and keep your accounts meticulously organised to ensure maximum compliance with tax regulations.